Payroll calculations for 2023

AFD CSD Price 2022. Answer A Few Easy Questions We Will Match You With Our Top Payroll Service Providers.

Budget Income Tax Slabs Proposed 2022 2023 Salary Tax Calculator

Ad Process Payroll Faster Easier With ADP Payroll.

. Ad Payroll So Easy You Can Set It Up Run It Yourself. The Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay. Start the TAXstimator Then select your IRS Tax Return Filing Status.

Ensure Accurate and Compliant Employee Classification for Every Payroll. The Salary Calculator has been updated with the latest tax rates which take effect from April 2022. It can also be used to help fill steps 3 and 4 of a W-4 form.

The 2023 Calculator on this page is currently based on the latest IRS data. See where that hard-earned money goes - with UK income tax National Insurance. Time and attendance software with project tracking to help you be more efficient.

Calculate how tax changes will affect your pocket. For example based on the rates for 2022-2023 a person who earns 49000 a year would pay an employee portion tax rate of 150 on the first 48000 and 9 on the balance of. This Tax Calculator will be updated during 2022 and 2023 as new 2023 IRS Tax return data becomes available.

How to calculate annual income. The official 2023 GS payscale will be published here as. The marginal tax rate is the rate of tax that employees incur on.

All Services Backed by Tax Guarantee. Ad Get Payroll Custom HR Policies Onboarding Terminations Performance Management More. Whether Active Duty National Guard or Reserve.

Ad Compare This Years Top 5 Free Payroll Software. As Americans try to cope with the highest. Ad From The Most Popular Payroll Services to Best for Small Business - Compare Costs Save.

As the IRS releases 2023 tax guidance we will update this tool. Its so easy to. Find 10 Best Payroll Services Systems 2022.

Our online tax calculator is in line with changes announced in the 20222023 Budget Speech. Enter up to six different hourly rates to estimate after-tax wages for hourly employees. 7th CPC Pay Calculator.

Use our employees tax calculator to work out how much PAYE and UIF tax you will pay SARS this year along with your taxable income and tax rates. Affordable Easy-to-Use Try Now. Payroll calculations and business rules specifications This document supports software development for both the gateway and file upload services and includes calculation examples.

Employee portion calculators can be found under Resources on this page. Free Unbiased Reviews Top Picks. To begin using the Military Pay Calculator first choose your status.

For example if an employee earns 1500. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Kenya PAYE Calculator with Income Tax Rates Of January 2022 Calculate KRA PAYE Net Pay NHIF and NSSF Contribution.

Get Started With ADP Payroll. You can use this calculator to prepare for your. For example based on the rates for 2022-2023 a person who earns 49000 a year would pay an employee portion tax.

Compare the Best Now. Expected DA July 2021. Sage Income Tax Calculator.

The table below shows the federal General Schedule Base Payscale factoring in next-years expected 26 across-the-board raise. Ad The New Year is the Best Time to Switch to a New Payroll Provider. Get Started With ADP Payroll.

Get your business set up to run payroll Figure out how much each employee earned Calculate taxes youll need to withhold and additional. Ad Break up with punch cards timesheets and long days of calculating everyones hours. E1-9 W1-5 or O1-10.

Discover ADP Payroll Benefits Insurance Time Talent HR More. Ad Customized for Small Biz Calculate Tax Print check W2 W3 940 941. Then scroll down to find your current pay grade.

To run payroll you need to do seven things. Payroll Calculations Business Rules 2023 V10 1 April 2022 to 31 March 2023 20 UNCLASSIFIED 54 M SL and ME SL Tax Code Student Loan calculations Sequence. Workers expect in 2023.

EzPaycheck makes it easy to calculate taxes print paychecks print tax form W2 W3 More. Discover ADP Payroll Benefits Insurance Time Talent HR More. Try out the take-home calculator choose the 202223 tax year and see how it affects.

Gross Pay Calculator Plug in the amount of money youd like to take home each pay period and this. Ad Process Payroll Faster Easier With ADP Payroll. Simply the best payroll software for small business.

FAQ Blog Calculators Students. 1 day agoWhat kind of pay raise can US. September 7 2022 913 AM MoneyWatch.

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Expected DA January 2022.

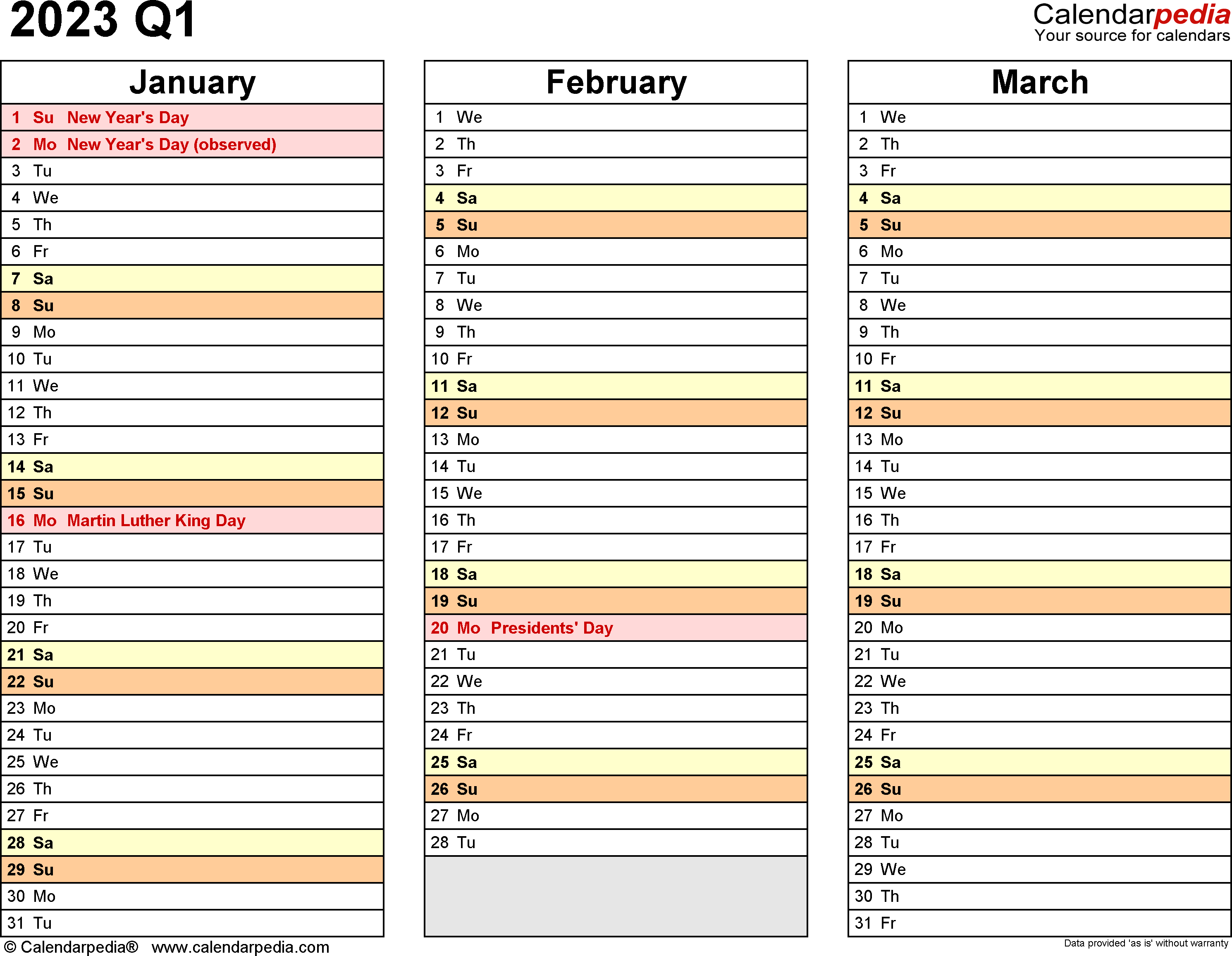

Quarterly Calendars 2023 Free Printable Word Templates

Quarterly Calendars 2023 Free Printable Excel Templates

2023 Calendar Pdf Word Excel

Social Security What Is The Wage Base For 2023 Gobankingrates

Quarterly Calendars 2023 Free Printable Pdf Templates

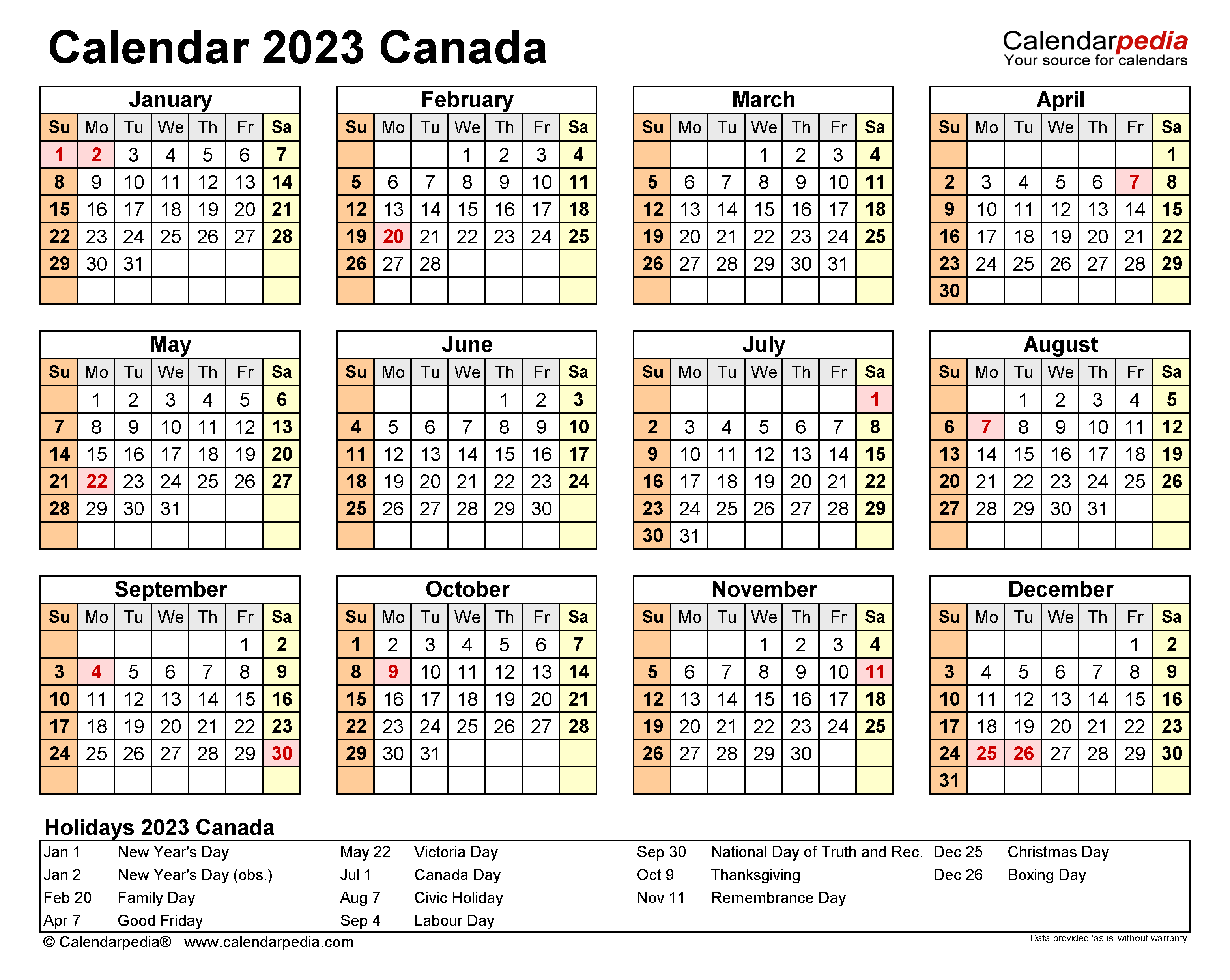

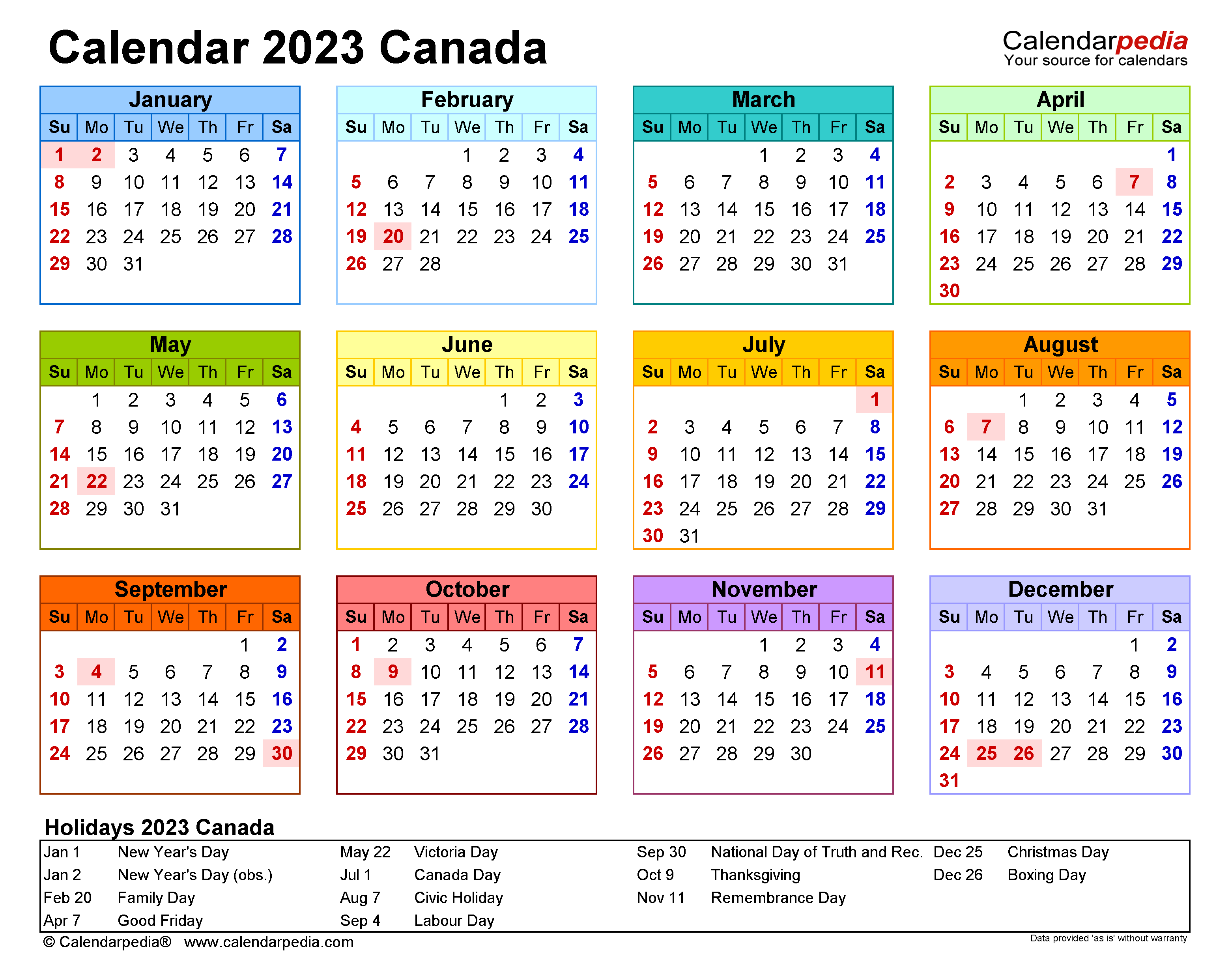

Canada Calendar 2023 Free Printable Excel Templates

Pay Scale Revised In Budget 2022 23 Chart Grade 1 To 21 Bise World Pakistani Education Entertainment Salary Increase Math Tutorials Salary

2

2023 Calendar Pdf Word Excel

Pack Of 28 Pay Salary Slips Templates Free Daily Life Docs Payroll Template Word Template Words

Canada Calendar 2023 Free Printable Excel Templates

Advanced Excel Spreadsheet Templates Excel Spreadsheets Templates Spreadsheet Template Excel Spreadsheets

My First Million By 16th October 2023 How To Get Money Credit Card App Business Travel Outfits

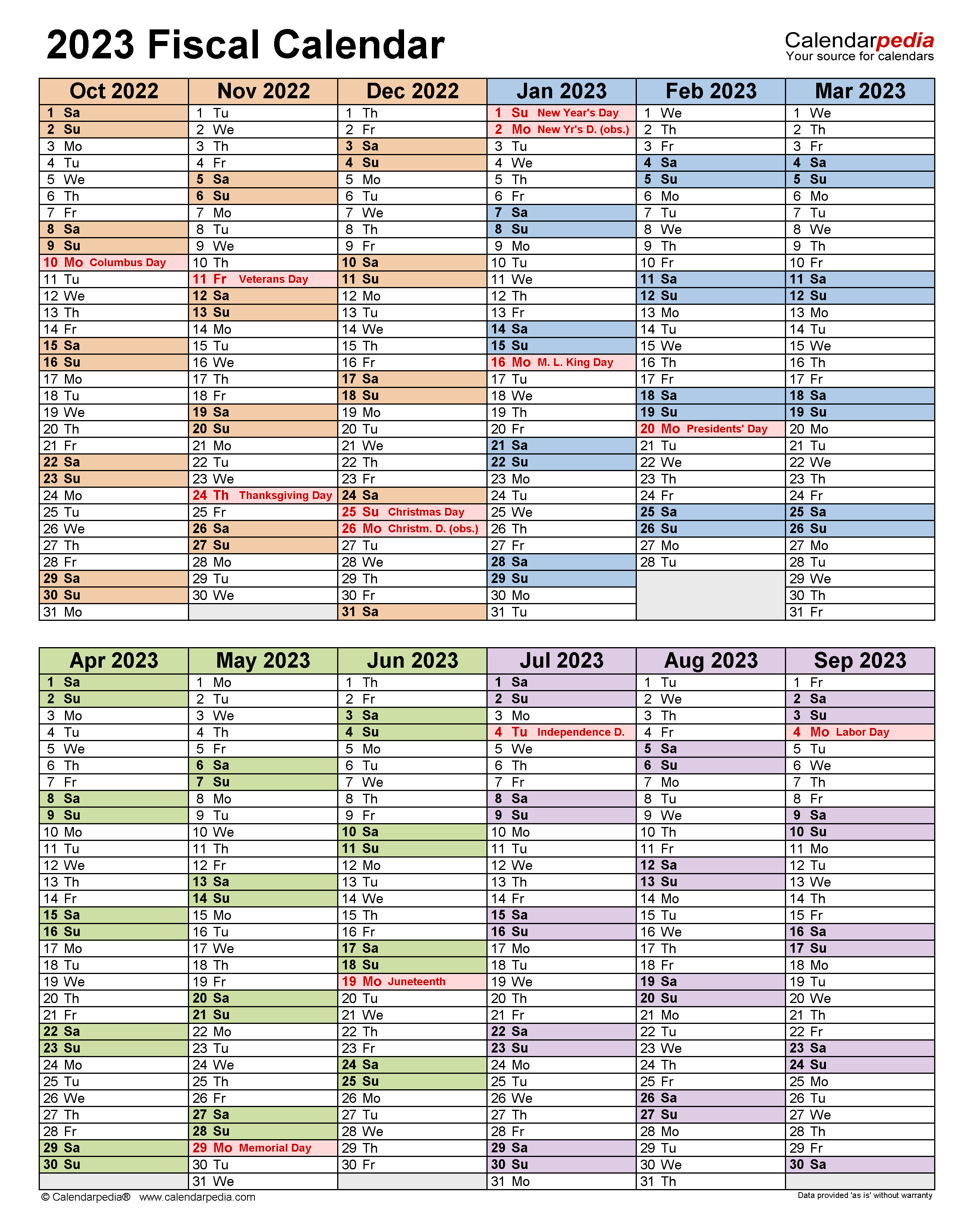

Fiscal Calendars 2023 Free Printable Excel Templates

Chart 4 1 National Productivity And Wages Over Time Budgeting Chart Government

2023 Preliminary Premium Rates Worksafebc

Payscale S Salary Budget Survey Is Open For Participation For 2022 2023 Payscale